![]()

Understanding Social Security Cards

Real vs Fake Social Security card. Social Security cards are essential documents issued by the Social Security Administration (SSA) in the U.S. They serve as a key to accessing various benefits and services. But did you know there are three different types of Social Security cards? Let’s break them down.

What are Social Security Cards?

A Social Security card is an official document issued by the Social Security Administration (SSA) in the United States. It contains a unique nine-digit Social Security Number (SSN) that is assigned to U.S. citizens, permanent residents, and certain temporary residents. This number is used to track individuals for Social Security benefits, tax purposes, and other government-related activities.

Key Features of a Social Security Card:

Social Security Number (SSN): The most important feature of a Social Security card is the unique nine-digit number. This number is assigned to each individual and serves as an identifier for government records, financial transactions, and various legal purposes.

Personal Information: The card typically contains the individual’s name and SSN, but it does not include additional personal details such as address, date of birth, or photo.

Security Features: While the card itself is not an identification card (like a driver’s license), it may include some security features such as special printing techniques to prevent fraud and counterfeiting.

Main Uses of a Social Security Card:

Tracking Earnings and Taxes: The Social Security Number (SSN) is used to track an individual’s earnings over time and ensure proper tax withholding for Social Security benefits. This number is also used for tax reporting purposes by employers.

Eligibility for Social Security Benefits: The SSN is critical for determining eligibility for Social Security benefits, including retirement, disability, and survivor benefits.

Opening Bank Accounts and Applying for Loans: Banks, financial institutions, and lenders often require a Social Security Number to open accounts, apply for credit cards, or take out loans. The SSN is used for background checks and credit reporting.

Tax Filing: Individuals use their Social Security Number when filing taxes with the Internal Revenue Service (IRS). The SSN is also linked to the individual’s taxpayer identification number (TIN).

Government Services and Benefits: A Social Security Number is often required to access various government services, such as applying for a passport, securing a job, or receiving government assistance programs.

Employment Verification: Employers require a valid Social Security Number to verify eligibility for employment in the United States. The SSN helps ensure that individuals are authorized to work and that proper tax contributions are made.

How to Obtain a Social Security Card:

To obtain a Social Security card, an individual must apply through the Social Security Administration (SSA). The application process typically involves submitting proof of identity and U.S. citizenship or lawful immigration status. Required documents may include:

- Proof of U.S. citizenship (e.g., birth certificate or passport) or immigration status (e.g., work visa or green card).

- Proof of age (e.g., birth certificate).

- Proof of identity (e.g., passport, driver’s license, or other government-issued ID).

The application process can usually be completed online, by mail, or in person at a local SSA office. Once the application is processed, the individual will receive their Social Security card in the mail.

Importance of a Social Security Card:

Protection of Identity: The Social Security card is an important identity document, and the SSN itself is a crucial piece of personal information. It is essential to protect the card and SSN from theft, as identity thieves often use SSNs to commit fraud or open accounts in someone else’s name.

Lifetime Use: The Social Security Number is a permanent identifier that stays with an individual for life. Even if someone changes their name, their SSN remains the same. This number is used throughout an individual’s life for a variety of government-related purposes.

What to Do If a Social Security Card Is Lost or Stolen:

If your Social Security card is lost or stolen, it’s important to report it to the Social Security Administration (SSA) immediately to prevent identity theft. The SSA allows individuals to apply for a replacement card online, by mail, or at a local SSA office. You will need to provide personal information and documents to verify your identity.

Protecting Your Social Security Number:

Since the SSN is a key piece of personal information, it’s important to protect it carefully. Here are some ways to safeguard your Social Security Number:

- Keep your Social Security card in a safe place and only carry it when necessary.

- Avoid sharing your SSN unless required by law or for essential purposes (such as taxes or financial transactions).

- Monitor your financial accounts and credit reports regularly to detect any unusual activity that could indicate identity theft.

A Social Security card is a vital document that serves as an official identifier for U.S. citizens and residents. It contains a unique Social Security Number used for a wide range of purposes, including tax reporting, eligibility for benefits, and employment verification. Protecting your SSN and card from misuse is crucial, as it is a key piece of personal information that can be used for identity theft or fraud. If you need a new or replacement card, you can apply through the Social Security Administration with the proper documentation.

Types of Social Security Cards

Card for U.S. Citizens and Permanent Residents

- Description: This card displays your name and Social Security number.

- Work Restrictions: None. Holders can work without any restrictions.

- Issued To: U.S. citizens and people lawfully admitted for permanent residency.

Card with Work Restrictions

- Description: Like the first type, this card shows your name and Social Security number but comes with a specific note.

- Work Restrictions: It reads, “VALID FOR WORK ONLY WITH DHS AUTHORIZATION”.

- Issued To: Individuals temporarily admitted to the U.S. who have authorization from the Department of Homeland Security (DHS) to work.

Card Without Work Authorization

- Description: Displays your name and Social Security number, with a note indicating limited use.

- Work Restrictions: “NOT VALID FOR EMPLOYMENT” is printed on these cards.

- Issued To: People legally in the U.S. without work authorization but who need a Social Security number for non-work-related reasons, like receiving federal benefits.

The Role of the SSA

The Social Security Administration is the official body that issues these cards. They ensure each card is unique and linked to an individual’s Social Security number (SSN). The SSA plays a crucial role in maintaining the integrity of the Social Security system, protecting against identity theft, and facilitating the issuance of these cards.

What is a Fake Social Security Card?

A fake Social Security card is a fraudulent or counterfeit document that imitates a legitimate Social Security card issued by the Social Security Administration (SSA). These fake cards are created to resemble authentic cards, often with altered or fabricated information such as a false Social Security Number (SSN), name, or other personal details.

Key Features of a Fake Social Security Card:

Altered or False Information: Fake Social Security cards typically contain incorrect personal information, such as a fake SSN, name, or date of birth. This information is often created or modified to match the person using the card or to assume a false identity.

Counterfeit Security Features: Genuine Social Security cards have specific security features that make them difficult to replicate, including watermarks and intricate printing techniques. A fake Social Security card might attempt to copy these features, but often lacks the same level of sophistication, making it easier to detect.

Intended for Illegal Purposes: Fake Social Security cards are often used for illegal activities such as identity theft, fraud, or securing employment illegally. The card allows individuals to appear legitimate, even though they are not authorized by the government.

Common Uses of a Fake Social Security Card:

Identity Theft: Fake Social Security cards are often part of identity theft schemes. Criminals may use them to steal someone else’s personal information, create fraudulent accounts, or engage in other illegal financial activities.

Employment Fraud: Individuals may use fake Social Security cards to gain employment illegally, particularly if they are not authorized to work in the United States or if they are attempting to hide their true identity from employers. Employers might not verify the authenticity of the SSN or Social Security card, allowing the individual to work under a false identity.

Fraudulent Applications: Fake Social Security cards may be used when applying for things like bank accounts, credit cards, loans, or other financial services under a false identity. By providing a fake card with an altered SSN, criminals can create a fake financial profile.

Avoiding Legal Restrictions: Some individuals might use a fake Social Security card to bypass immigration laws, gain access to restricted services, or avoid legal obligations, such as paying taxes, child support, or other government-related duties.

Consequences of Using or Possessing a Fake Social Security Card:

The use or possession of a fake Social Security card is a serious crime under federal law. Depending on the circumstances, individuals caught with a fake card can face significant legal penalties. These include:

Criminal Charges: Possessing or using a fake Social Security card is considered fraud or identity theft. The individual may be charged with federal crimes, including the use of false identification or documents, which can result in criminal prosecution.

Fines and Imprisonment: Individuals convicted of using a fake Social Security card can face substantial fines and prison sentences. The penalties depend on the severity of the offense and whether it was part of a broader scheme (such as organized fraud or identity theft).

Loss of Employment: If an individual is caught using a fake Social Security card for employment, they may lose their job and be reported to authorities. Employers are required to verify the validity of an SSN, and using a fake card can lead to the termination of employment.

Damage to Reputation: Being caught using a fake Social Security card can significantly damage an individual’s reputation. It can lead to a criminal record, making it difficult to find legitimate work or secure other services in the future.

How to Protect Against Fake Social Security Cards:

Verify SSNs: Employers and organizations should always verify the authenticity of the Social Security number provided by employees, especially when completing forms such as W-2s, tax returns, and employment applications. The E-Verify system can be used to check whether the SSN matches the person’s identity.

Monitor Your SSN: Individuals should regularly monitor their credit reports and financial accounts for signs of fraudulent activity that could be linked to identity theft or the misuse of their SSN.

Secure Your SSN: People should avoid carrying their Social Security card unnecessarily and keep it in a safe place. Never share your SSN unless required for a legal or financial transaction.

Report Fraud: If you suspect that your Social Security card has been stolen or that a fake card has been used with your SSN, immediately report it to the Social Security Administration (SSA) and Federal Trade Commission (FTC). This helps prevent further misuse of your identity.

How Fake Social Security Cards Are Created:

Fake Social Security cards are often produced by criminal organizations or individuals with access to printing technology and forged documents. These forgers typically use software and printing techniques to create fake cards that look similar to real ones. Some may obtain real SSNs through illegal means, while others create entirely fake numbers. In either case, the goal is to produce a document that appears legitimate enough to be accepted by banks, employers, or government agencies.

A fake Social Security card is a fraudulent document that impersonates a legitimate SSN card issued by the U.S. government. These fake cards are commonly used for identity theft, fraud, illegal employment, or evading legal restrictions. The creation or use of a fake Social Security card is illegal and can result in severe criminal penalties, including fines, imprisonment, and long-term damage to one’s reputation. It is essential to protect your SSN and report any suspected misuse to prevent identity theft and legal consequences.

Work Restrictions Explained

Work restrictions on Social Security cards are vital for maintaining lawful employment standards in the U.S. They help employers verify the work eligibility of individuals. For example, a card stating “VALID FOR WORK ONLY WITH DHS AUTHORIZATION” means the individual can work but must have additional permission from DHS.

Understanding these distinctions is crucial. It helps ensure compliance with U.S. employment laws and protects against fraudulent activities involving Social Security cards.

In the next section, we’ll dive deeper into how to spot a real vs fake social security card, ensuring you’re well-prepared to identify any red flags.

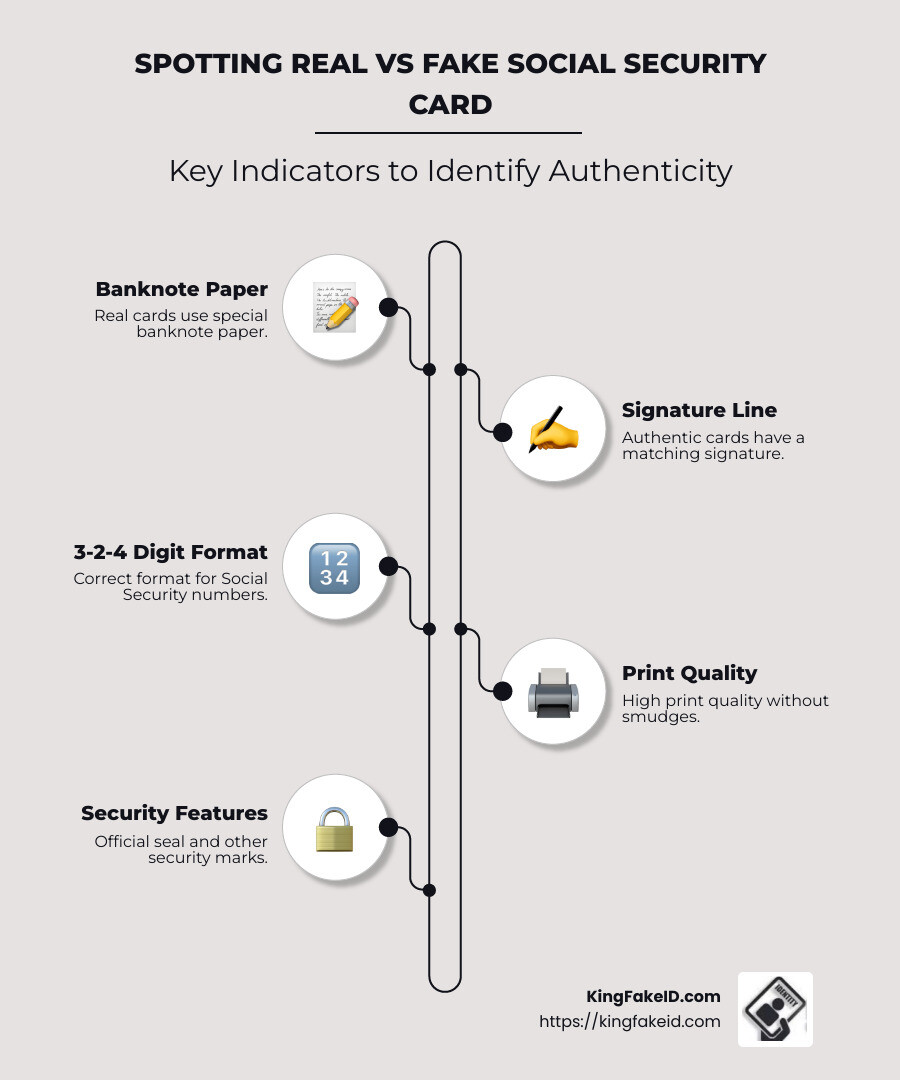

Real vs Fake Social Security Card: Key Differences

Spotting the difference between a real and fake social security card can be tricky, but understanding key features can make it easier. Let’s explore the main elements that set authentic cards apart from counterfeit ones.

Banknote Paper

Real Social Security cards are printed on unique banknote paper. This isn’t your everyday paper—it’s specially designed to prevent counterfeiting. It feels different, almost like the paper used for currency. If a card feels like regular printer paper, it’s likely a fake.

Security Features

Authentic Social Security cards come packed with security features to deter forgery. Here are some key elements:

- Planchettes: These are tiny, multi-colored discs scattered across the card. They are visible to the naked eye and add an extra layer of security.

- Erasable Tint: The background has a blue tint with a marbleized pattern. This tint can be easily erased, making tampering evident.

Intaglio Printing

One of the most distinctive features of a genuine Social Security card is intaglio printing. This technique, also used in U.S. currency, gives parts of the card a raised, tactile feel. It’s not something easily replicated by counterfeiters. If you run your fingers over the card and don’t feel any raised print, it might be a forgery.

Other Essential Checks

Besides these features, always check for the official seal of the Social Security Administration (SSA) and the card’s overall print quality. Legitimate cards have uniform numbers, clear spacing, and no ink smudges.

Understanding these differences can help you spot a fake card quickly. Next, we’ll discuss practical tips for identifying counterfeit Social Security cards, ensuring you’re equipped to safeguard your identity or business.

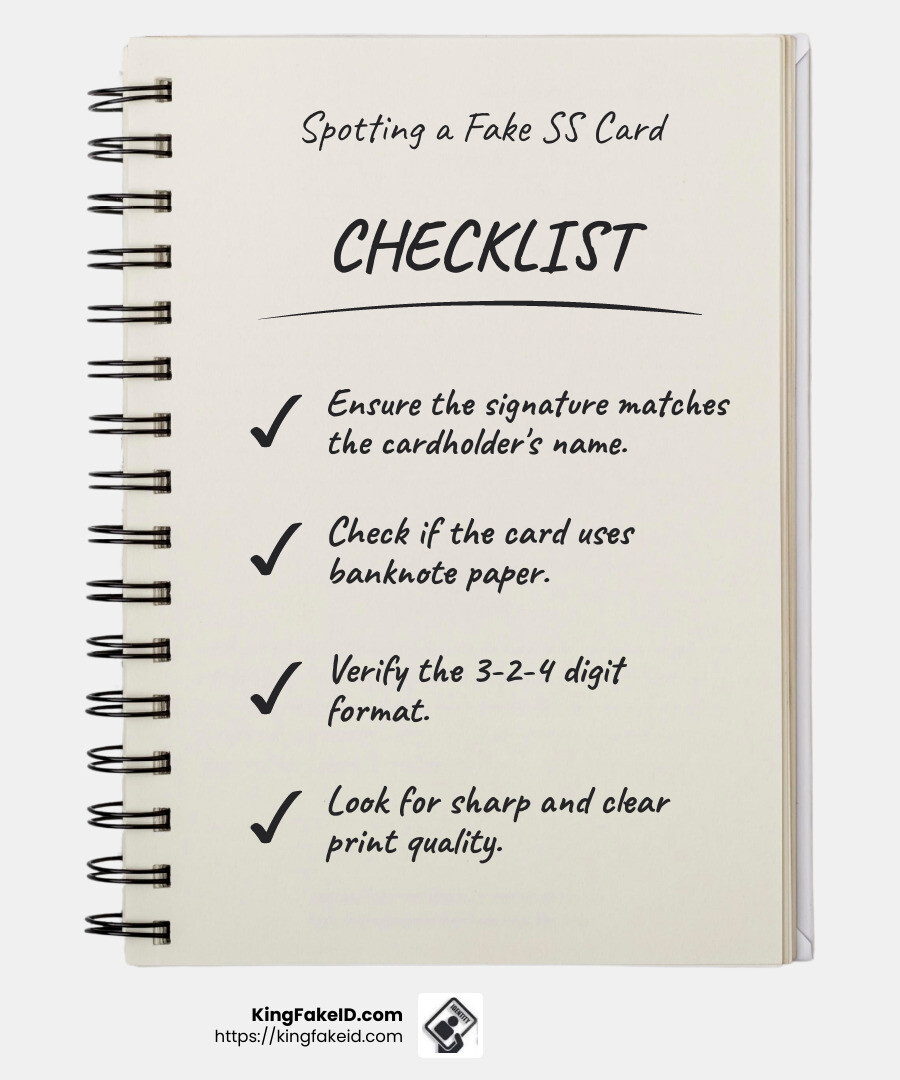

How to Spot a Fake Social Security Card

Spotting a fake Social Security card isn’t just about looking closely—it’s about knowing what to look for. Here’s how you can identify a counterfeit card using four key checks:

Signature Match

A real Social Security card should have a signature that matches the cardholder’s name. This signature should be clear and legible, written on the line provided. If the signature seems off or if there’s no accompanying statement of impairment from the SSA, that’s a red flag.

Paper Quality

The quality of the paper is a telltale sign. Authentic cards are made with special banknote paper that feels rough and weighs more than regular printer paper. If a card feels like standard paper, it’s probably fake.

Digit Format

Pay attention to the format and sequence of the digits. A real Social Security number follows a 3-2-4 digit format. Watch out for unlikely sequences like 5555, as these are rare in genuine numbers. Also, certain numbers, like 000 or 666, are never used.

Print Quality

Examine the print quality closely. Use a magnifying glass if needed. On a real card, the print will be sharp and clear. There should be no smudges or misaligned fonts. The numbers should be of uniform height and width, with even spacing.

By checking these elements, you can quickly identify a fake Social Security card and protect yourself from potential fraud. Next, we’ll answer some frequently asked questions about Social Security cards to further improve your understanding.

Frequently Asked Questions about Social Security Cards

How can you tell if a Social Security card is real?

A real Social Security card has distinct features that make it stand out. First, check the paper’s quality. Real cards are printed on pre-printed banknote paper, which feels rough and is thicker than regular paper. This special paper is similar to what is used for currency, making it harder to replicate.

Next, look for the official seal of the Social Security Administration (SSA). This seal is a key security feature, and its presence is crucial in verifying the card’s authenticity. If the seal is missing or looks different from the official design, the card might be fake.

How do I know if my SSN is real?

To verify if your Social Security Number (SSN) is real, you can check your credit reports for any discrepancies or unauthorized activity. This can help you identify if your SSN is being used fraudulently.

Additionally, you can contact the SSA directly to confirm the validity of your SSN. They can provide information on whether your number has been issued and if it’s associated with your name.

How to find out if someone is using a fake social security number?

If you suspect someone is using a fake SSN, start by reviewing your credit reports. Look for any accounts or inquiries you don’t recognize. This could indicate that someone is using a fake or stolen SSN to open accounts in your name.

You can also verify personal information with institutions that have your SSN on file. Make sure your details match what they have and inquire about any unusual activity. If you find discrepancies, report them immediately to the SSA and consider placing a fraud alert on your credit reports.

By staying vigilant and using these verification methods, you can protect yourself from identity theft and the misuse of fake Social Security numbers.

Conclusion

Detecting and reporting Social Security fraud is crucial in today’s world where identity theft is a growing concern. If you suspect fraud, it’s important to act quickly. Gather as much information as possible about the potential fraud, such as names, addresses, and any suspicious Social Security numbers. Then, report your findings to the Social Security Administration (SSA) or the Office of the Inspector General (OIG). They have hotlines and online forms to facilitate reporting.

You can choose to remain anonymous, but providing your contact information can help the authorities conduct a thorough investigation. While you may not receive updates on the status of your report, your input is valuable in combating fraud.

By staying informed and vigilant, you can protect yourself and others from falling victim to identity theft and fraud.